The expansion of the CFO role is one of the most overblown clichès going. Yawn. But….some F500 companies are officially combining the CFO and COO roles to create a new COFO seat responsible for finance and operations. Is the COFO title a real evolution of the CFO role or is it window dressing over a CFO’s existing responsibilities? And what does it take to become a successful COFO?

Veterans wanted. The right CFO for the COFO role is a little grey at the temples and knows operations from experience.

Back office boss? The COFO role works in industries where the ‘operations’ are back/middle office functions.

Two minds. Handling both finance and operations takes mental dexterity and discipline.

—

Read time: 8 minutes 52 seconds

⧗ Written by Katishi Maake and Secret CFO

A WORD FROM THIS WEEK’S SPONSOR...

Do you hear that? It's the calm before the (audit) storm

2026 audit season is coming in hot. Which means your org can be prepared, or you can be frantically searching for “Q3_supporting_docs_v7.pdf" at 11 PM in a few weeks.

Campfire, PWC, and CFGI want to help you skip the scramble with their 2026 Audit Readiness webinar. They'll dive into what auditors will expect, what to prep now, and how AI can help.

There’s the expansion of a CFO’s responsibilities and then there’s going Godmode…

When Salesforce recently appointed longtime board member Robin Washington as Chief Operating & Financial Officer (COFO), the software giant became one of the largest companies to merge the responsibilities of CFO and COO into one role.

Robin Washington - Salesforce COFO

And she’s taking on almost everything. In her newly-created role, Washington will oversee business strategy and operations, global finance, employee success, global strategic customers and partners, marketing, communications, and real estate and workplace services.

While that seems like an enormous remit to tackle, this is not Washington’s first rodeo. She’s had 20 years in tech boardrooms. More notable though, is that (according to her LinkedIn profile) this new appointment is her first executive position in six years; since she left her role as CFO of biopharma giant Gilead Sciences in 2019. Since then she’s served on the boards of Alphabet, Honeywell, and Salesforce itself. Once veteran execs get that taste of the sweet plural life, it’s unusual for them to go back into a full time position.

But after 12 years as a Salesforce board member, she clearly built a strong foundation of trust with founder and CEO Marc Benioff.

Upon her appointment, Benioff said that Washington’s “operational mastery, financial expertise, and strategic vision make her the perfect leader to guide Salesforce through this transformational shift,” in a press release. In other words, Washington knows her way around all the important parts of the business.

But Salesforce isn’t the only Fortune 500 company to recently announce a COFO. PayPal CFO Jamie Miller took on the COO duties and title in February. Miller’s promotion was also timed to a number of strategic growth initiatives, including an expanded relationship with J.P. Morgan Payments. Critically, Miller has been an important part of PayPal’s recent transformation efforts.

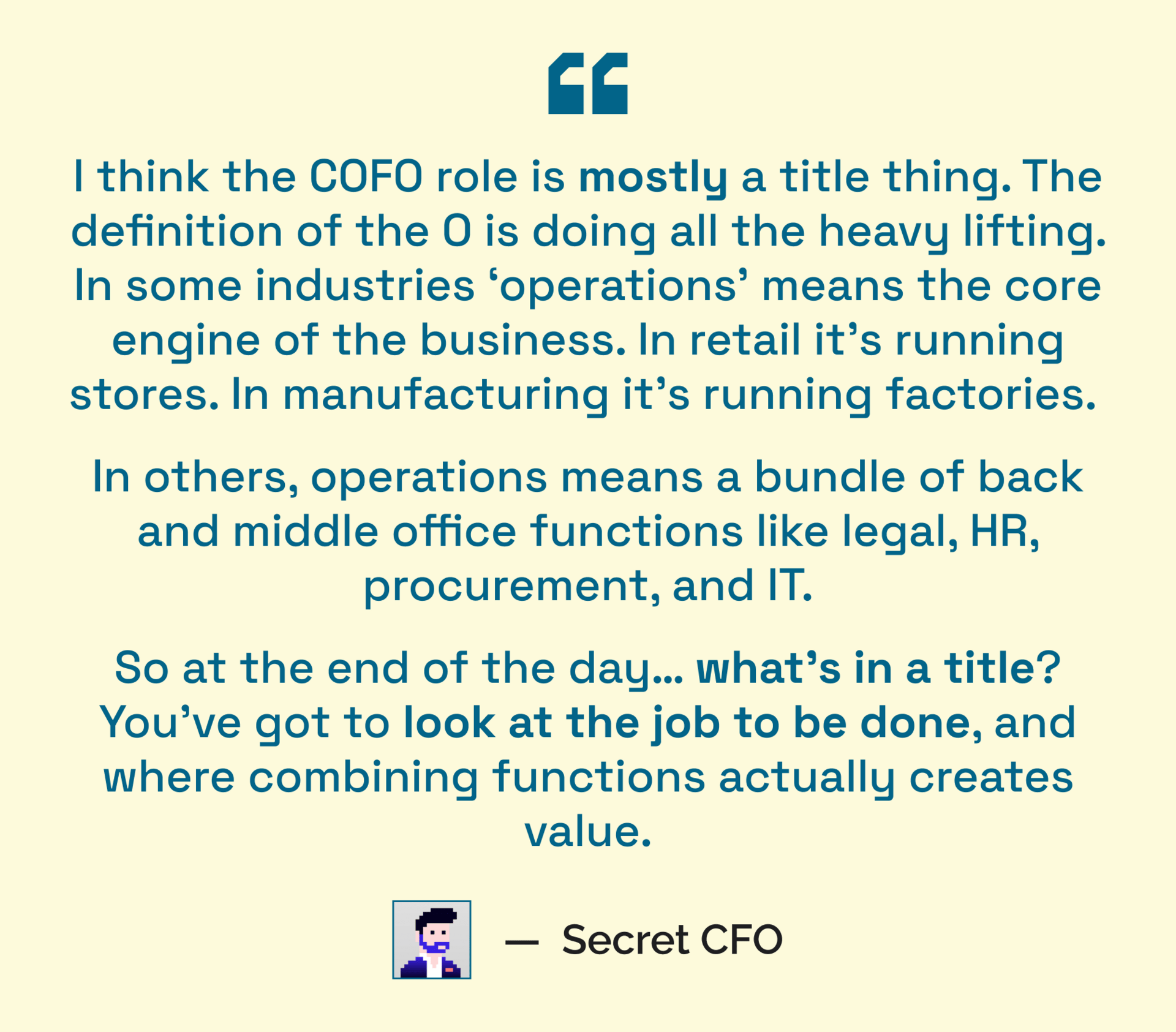

And while a ‘COFO’ title is an emerging phenomenon in the biggest companies, they have been a fixture in smaller businesses for a long time. And often CFO’s sweep up broader operational responsibilities without the title inflation. It somewhat depends on the industry.

“It makes sense in a high-margin business like a software business where your operational side tends to be more people and admin focused,” said Adam Peaker, founder of CFO consultancy firm SoloCFO. “Your typical manufacturing business or product business where they’re making a good and selling that good…I don’t think a CFO is going to have the pedigree to step in and take over.”

So don’t start adding operations experience to your resume just yet.

Experience matters

Peaker knows what he’s talking about; he steered the operational and financial duties at his former company Fully, an office furniture retailer. He oversaw operational duties, including IT systems, supply chain, distribution, and customer success, along with the finance function, during the pandemic. That’s a true operations role. During that time, the company’s revenue climbed from $30 million to $120 million a year.

Peaker said the combination made sense for a smaller business, especially where day-to-day operations were led by strong FP&A .

Peaker said “from an operational perspective, it made way more sense to house everything under one position.”

At the time, a COFO-type role made sense for Fully because:

they had a very, green inexperienced operations function at the time.

day-to-day operations had a huge affect on cash, forecasting, and financial planning, and vice versa.

Peaker’s skillset, previously working in process design, allowed him to streamline operations quickly without “throwing bodies at the problem.”

It was a challenging but manageable workload for Peaker because of the relatively small size of the business.

But how does it work in a larger business?

Of two minds

Long story, short: it’s a balancing act. Justin Smith is the chief financial and operating officer at ITN, one of the U.K.’s largest daily news operations. Smith didn’t take the traditional finance path to CFO. While Smith does have a finance background, he’s also overseen M&A strategy and worked as a program manager within media organizations. That broad experience proved useful for what would follow.

For a broadcast media company, dealing with operational challenges can happen with the cameras rolling and problems need to get dealt with immediately before they end up in front of the audience. At ITN, operations can include anything from a lighting malfunction in a studio to monitoring the risk profile of a journalist in a dangerous region. So no pressure there.

It’s wide-ranging and pulls Smith in many directions and requires an internal tension between the “CFO brain” and the “COO brain,” he said.

For example, the COO brain sees the need to upgrade the studio to prevent risk and ensure the quality of the broadcast. On the other hand, the CFO brain asks, “couldn’t we ‘sweat the asset’ for another year? Where’s the payback case?”

It’s a constant strain Smith grapples with personally but he’s not the only one. There’s a push and pull between the two roles for the people around him too. He carries both the bottom-up tension of operational reality and the top-down pressure to deliver what the board expects.

That helps give Smith the broadest perspective and make the right decision for the business overall.

“Reacting operationally…you sometimes argue against yourself from a financial perspective,” he said. You ask yourself, “is that decision something I would approve as a CFO or am I trying to approve it as a COO. Sometimes there’s a little bit of that internal tension.”

Will we see more COFOs?

You would think so, yes.

But while most companies of a certain size have a CFO, not every organization needs a COO. And those that do often have highly complex operational systems, too unwieldy to sit in one office.

And sometimes that separation of duties is essential to keep the organization focused and well controlled. For example, Alex Mostovoi is CFO of financial services firm OnePoint BFG Wealth Partners. While the company technically has a COO, he said that individual is largely responsible for overseeing M&A.

Most of the day-to-day operational duties sit with Mostovoi, as he says the CFO typically has a clear view of what’s happening with most of the business.

It depends on the industry

The COFO role suits some industries better than others. Mostovoi believes this is a trend when it comes to financial services. Mostovoi served as CFO and COO of Emigrant Bank for 7 years.

In financial services ‘operations’ is largely about moving money and trades safely and accurately.

He said because deals, money movement, and investment work require close oversight, the CFO role already has a deep visibility into operations within financial services.

As CFO, he knows when a wire payment is due, the expected amount, and the counterparty, making him better positioned to manage the operational process than a separate ops leader who would have to be caught up.

And in Mostovoi’s view, digitization will streamline financial services operations even further and make it more likely that those responsibilities sit under the CFO.

“Bring in the CFO on top of that—who is probably one of the people who best knows the business—then that may make sense,” he said. “That’s where things are going, because of the new technologies that weren’t around five, 10, 15 years ago.”

COFO roles are not going away. We will see more of them as emerging tech strips out lower-value work. But you do not need the title to own operations. In some industries operations is the beating heart of the business. In others it is a tidy bundle of back office functions. The broader and closer to the front line it gets, the more it deserves to stay a standalone role.

So if you have your eye on a COFO title, remember this: it’s just a label. The real game is what sits underneath it.

Reading The Room…

The questions your board will ask - beat them to it:

How do we define operations in our business? What is the mix of front, middle, and back office functions, and why are those boundaries drawn the way they are?

What value could be unlocked by recutting the battle lines between those functions? Where would shifting responsibilities improve speed, cost, quality, or control?

How do automation and AI adoption change those boundaries? Which functions collapse, which scale, and which disappear as technology matures?

How tightly linked are finance and operations today? Where is the integration natural versus forced, and what does that imply about ownership and design?

What functions could be logically consolidated under one office without degrading control, oversight, or pace? And which should never be consolidated?

Boardroom Brief is presented by The Secret CFO and the CFO Secrets Network

You can check out our other newsletters here.

If you found this helpful, please forward it to your fellow finance leaders (and maybe even your Board). If this was forwarded to you, you can make sure you receive the next edition by subscribing here.

Let us know what you thought of today’s piece, by hitting reply to this email.

Want to contribute? Your insight could feature in a future edition of Boardroom Brief. Just click here and tell us what the big things on your board's agenda are.